Wealth Planning

As a CFP Professional, I serve families and in all areas of financial planning. Financial planning is the collaborative process of developing accurate financial goals that are important to you, creating a plan of action to work toward those goals, and finally monitoring your progress and making adjustments to ensure we stay on track.

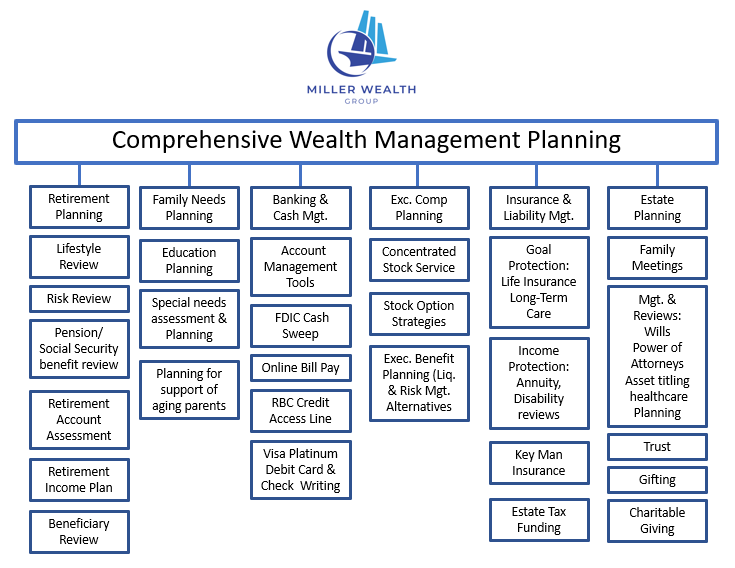

Financial Planning can be utilized to address a specific goal or through a comprehensive plan designed to multiple stated financial priorities ranging from:

Retirement Income Planning

Educational Planning

Saving for a major purchase

Risk Management Planning

Legacy Planning

Please call us if you have any questions about our firm or the range of financial products and services we provide. Our firm has a relationship with a variety of financial services companies, so if we don’t have a product or service, we know a group that does.

Start Your Comprehensive Financial Plan Today.

Click here to Book a time with John!

Tailored Investment Solutions & The Fiduciary Standard

My holistic approach to personal financial planning services is instrumental in meeting my client’s financial goals through building thoughtful portfolios with the end-results in mind. I help the individuals understand their specific risk tolerance and what investment vehicles may be most appropriate in meeting their unique financial need.

In the current market environment of ultra-low interest rates, my tailored investment approach seeks to minimize cost, while achieving risk-adjusted returns that are aligned with the unique needs of the clients I serve.

As a CFP Professional, the Fiduciary Standard is a core covenant in my approach to managing client’s wealth. The Fiduciary standard, as defined by the SEC, is a requirement in which the advisor must at all times serve the best interest of their clients. This overarching principle of duty of care and duty of loyalty means you can take comfort in recognizing I strive to provide the best options for my clients.